It may be hard to think about tax time and tax refunds with the holidays upon us however; this is the best time to start thinking about it. The holidays can definitely be a time of year when over spending can happen and a tax refund can be a great tool to alleviate the build up of holiday debt. It is a great idea to have a plan in place before that tax refund arrives.

A favorite plan of mine for a tax refund is the 1/3 rule. Save 1/3, spend 1/3 and use 1/3 to pay down on debt. That way you can start your year ahead of the game and maybe even make a plan for holiday spending for next year! The average return is just under $3,000. Think of the jump you can get on holiday spending for 2016 when you save $1,000 at the beginning of the year. Or you could jump-start your emergency fund for the year, put a chunk into your retirement fund. Whatever you decide to do with your refund, make a plan to save a portion of it. You could even win $25,000 for doing so.

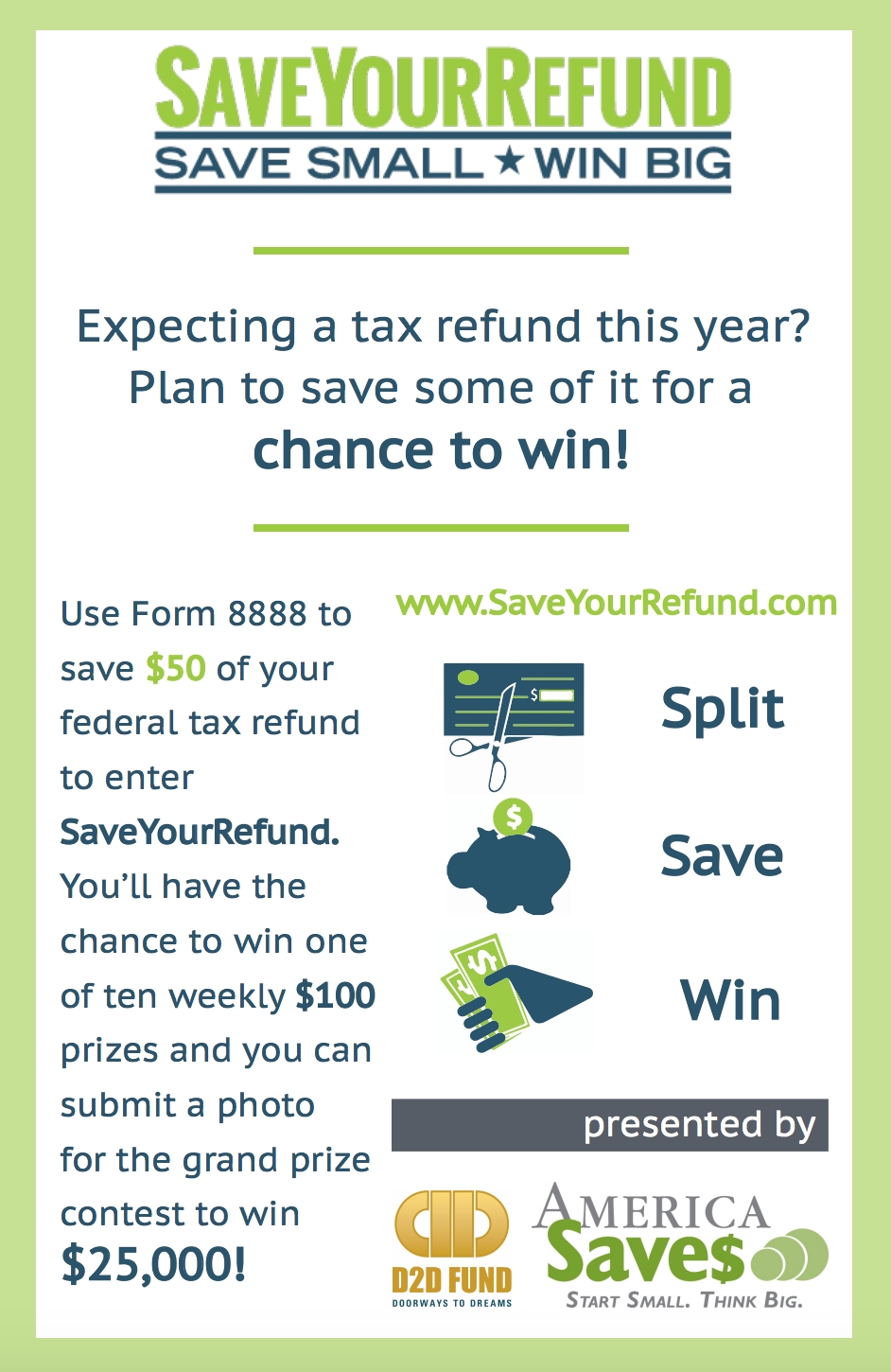

Save your refund is a program where you can save part of your refund for a chance to win one of over 100 prizes! It’s easy and a win – win. Use IRS Form 8888 to split your refund and save at least $50 of your federal refund into a savings account to qualify. For more information check out: SaveYourRefund.com and check out the grand prize winner from 2015. Stay tuned for more information!